jefferson parish property tax search

Assessed Value 20000. Pay Property Taxes Online.

Jefferson Parish Louisiana Department Of Health Lift Do Not Drink Order Boil Water Advisory For Grand Isle 01 18 Yyyy

Get In-Depth Property Reports Info You May Not Find On Other Sites.

. Enter the Address to Begin. Parish Taxes View Pay Water Bill BAA Fine Submit Street Light Outage. The preliminary roll is subject to change.

Jefferson Davis Parish Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Jefferson Davis Parish Louisiana. Search Any Address 2. The Jefferson Parish Assessors Office determines the.

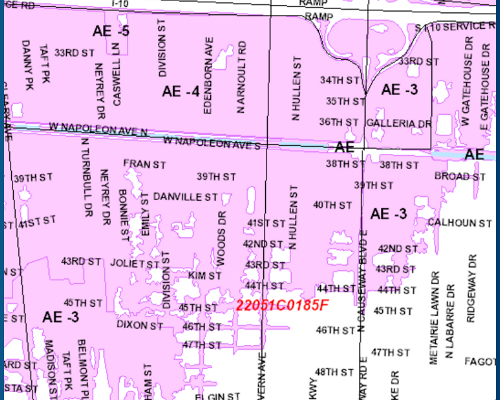

The AcreValue Jefferson Parish LA plat map sourced from the Jefferson Parish LA tax assessor indicates the property boundaries for each parcel of land with information about the landowner the parcel number and the total acres. You may request public records from Jefferson Parish by e-mail fax mail or in person. Jefferson Parish Health Unit - Metairie LDH.

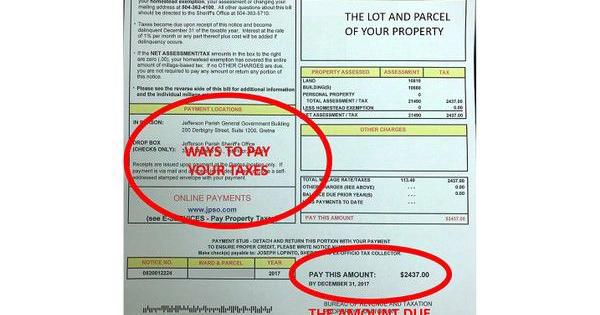

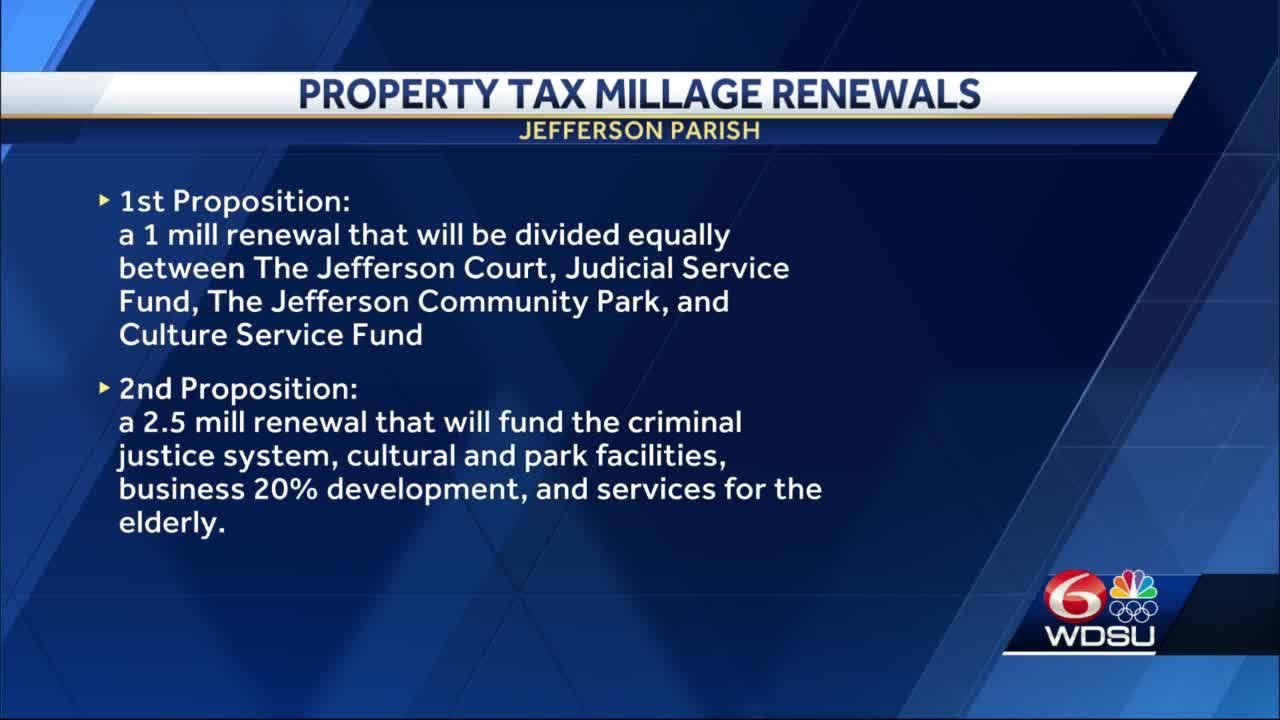

Please call 504-362-4100 and ask for the personal property department if you have any questions. Title History ownership title history deeds and mortgage records. The tax rate is the sum of the individual millage that were approved by voters for such purposes as fire protection law enforcement education recreation and other functions of parish government.

Parcel Owner Location Assessment. This property includes all real estate all business movable property personal property and all oil gas property and equipment. These records can include Jefferson Davis Parish property tax assessments and assessment challenges appraisals and income taxes.

Welcome to the Jefferson Davis Parish Assessor Web Site The Jefferson Davis Parish Assessor is responsible for discovery listing and valuing all property in the Parish for ad valorem tax purposes. If you are seeking certification of taxes paid for the purposes of an act of sale re-financing or to comply with other legal requirements please click the Tax Research Certificate button below to order one online or contact the Bureau of Revenue and Taxation 504 363-5710 for a tax research certificate. Welcome to the Jefferson Parish Assessors office.

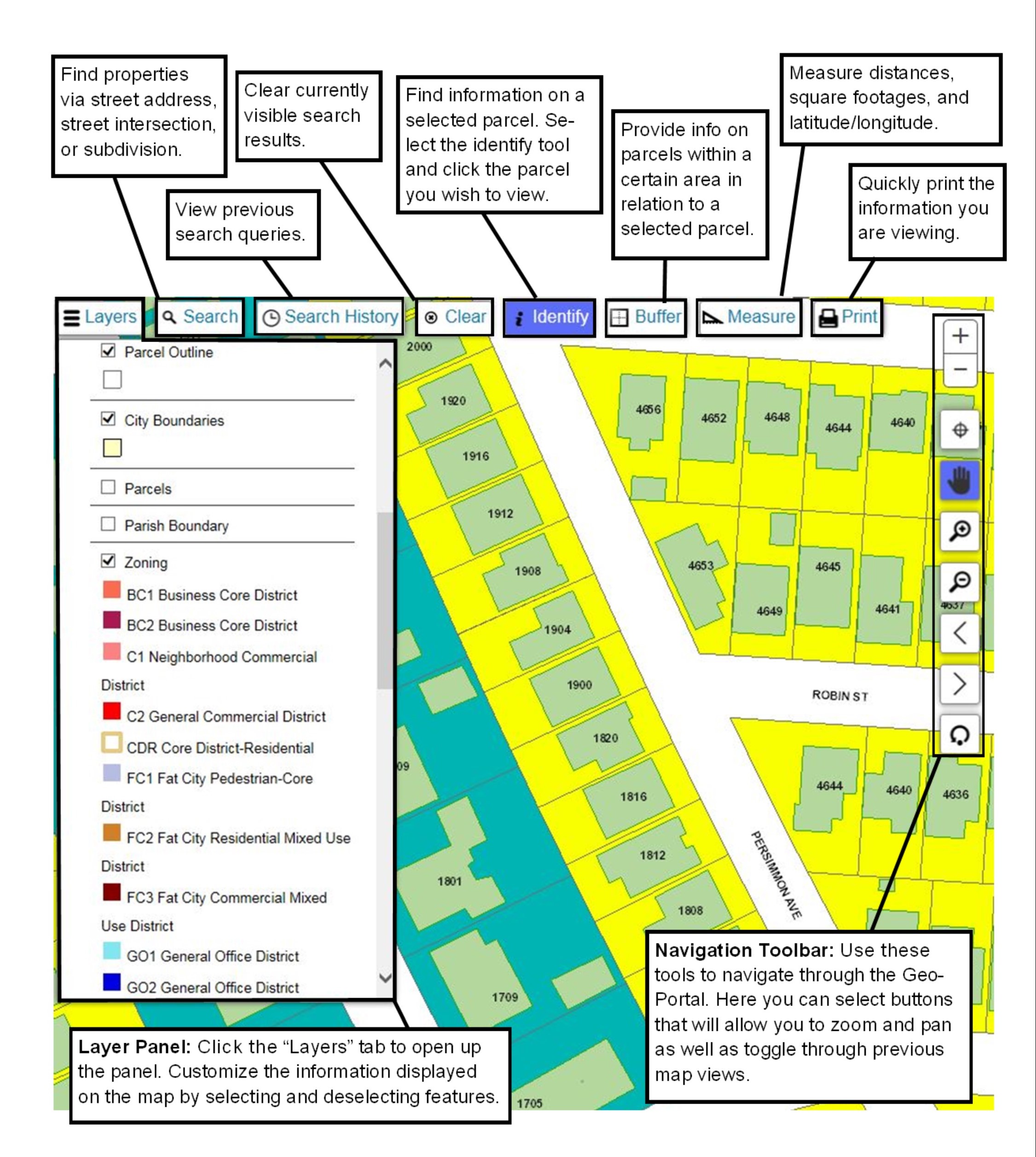

Voluntary Liens titles deeds mortgages releases assignments foreclosure records. Homestead Exemption Deduction if applicable-7500. Jefferson Parish has developed a Geographic Information Systems GIS database using aerial photography and field investigations.

Requests for payoffs on liens orders and judgments in favor of the Parish of Jefferson may be obtained by providing the following. Name address telephone number fax number email of person or entity requesting the information. Assessed value is the Taxed value if no Homestead Exemption is in place.

200 Derbigny St Suite 1100. Its office is located in the Jefferson Parish General Government Building 200 Derbigny Street Suite 1200 in Gretna and is open to the public from 830 am. Get Property Records from 1 Treasurer Tax Collector Office in Jefferson Parish LA Jefferson Parish Sheriffs Office 100 Huey P Long Avenue Gretna LA 70053 504-363-5701 Directions Jefferson Parish Building Departments.

This website will assist you in locating property ownerships assessed values legal descriptions estimated tax amounts and other helpful information that pertain to the Assessors office. Mississippi Texas Arkansas Alabama Oklahoma. Jefferson Property Records provided by HomeInfoMax.

Search Jefferson Parish property tax and assessment records by parcel number owner name address or property description. Once the preliminary roll has been approved by the Louisiana Tax Commission the 2020 assessments will be updated on the website. Read Local County Assessor Records to See the Propertys Assessed Value.

Involuntary Liens mechanics liens. Ad A Comprehensive Property Tax Search Just Takes 12 Minutes. Municipal address of the property for which a payoff quote is requested.

Property Tax Calculation Sample. Carbon farming practices have shown a. Property Reports ownership information property details tax records legal descriptions.

Millage Rate for this example we use the 2018 millage rate for Ward 82 the Metairie area x11340. Our objective is to assess all property within Jefferson Parish both real and personal as accurately and as equitably as possible. Jefferson Parish Assessors Office - Property Search.

See Property Records Deeds Owner Info Much More. Jefferson Parish Code of Ordinances Section 2-151 requires the Parish Attorneys Office to administer and fulfill all requests for public records made to Jefferson Parish. Please be advised the 2020 preliminary roll has been uploaded to the Jefferson Parish Assessor website.

Market Value 200000. Taxed Value 12500. To 430 pm Monday through Friday.

Assessor Jefferson Parish Assessor 200 Derbigny St Suite 1100 Gretna LA 70053 Phone. 504 366-4087 Jefferson Parish Assessor 1221 Elmwood Park Blvd Suite 901 Jefferson LA 70123 Phone. These taxes may be remitted via mail hand-delivery or filed and paid online via our website.

Its Fast Easy. Click here for Section 2-151. Property Records Apply For Employment with the Parish.

Office of Motor Vehicles. Jefferson Parish makes no warranty as to the reliability or accuracy of the base maps their associated data tables or the original data collection process and is not responsible for the inaccuracies that could have occurred due to errors in the. The telephone is 504-363-5637.

Jefferson Parish Property Tax Bills Are In The Mail Local Politics Nola Com

Property Tax Jefferson County Tax Office

Jefferson Parish Property Taxes Are Set For 2018 Local Politics Nola Com

Jefferson Parish Property Taxes Are Set For 2018 Local Politics Nola Com

E Services Jefferson Parish Sheriff La Official Website

Jefferson Parish Residents Will See Several Millages On Ballot

November Election Results For Jefferson Parish Wwltv Com

Payments Jefferson Parish Sheriff La Official Website

Jefferson Parish Property Owners Will Pay More Taxes Soon Here S Why Local Politics Nola Com

Kean Miller Wins Major Property Tax Case At Louisiana Supreme Court Louisiana Law Blog

![]()

Property Tax Jefferson County Tax Office