foreign gift tax uk

But her friend must pay Inheritance Tax on her 100000 gift at a rate of 32 as its above the tax-free threshold and was given 3 years before Sally died. You will not have to pay tax on this though.

Gifting To Us Persons A Guide For Foreign Nationals And Us Donees Bny Mellon Wealth Management

There is a UK inheritance tax exemption on gifts of 3000 per year 2500 for a grandchild or great-grandchild 5000 for a child or between 1000 and 5000 on wedding.

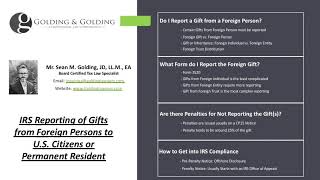

. Reporting the Foreign Gift is a key component to IRS law. Get in touch today. 13 April 2016 at 938.

The Inheritance Tax due is. With a dedicated US-based pension advisor we will guide you through the transfer process. Ad Florin Pensions specialises in UK pension advice for expats in the US.

Before the finance act. The value of the gifts received from foreign corporations or foreign partnerships must exceed 16815 as of tax year 2021. 24th Feb 2020 1359.

There will be no income tax due on the gifting of money. Your executor might be able to reclaim tax through a double-taxation treaty if Inheritance Tax is charged on the same assets by the UK and the country where you lived. IRS Form 3520 is required if you receive more than 100000 from a nonresident alien or a foreign estate.

1 IRM 425441 paragraph 2 was revised to provide current instructions for requesting FATCA data in estate and gift tax examinations. Treaties with estate andor gift tax provisions can be found at the International Bureau of Fiscal Documentations Tax. In the UK there are three rates of income tax which would be apply to an individuals income in a tax year starting at 20 for an income of 31785 or lower 40.

How much money can you receive as a gift from overseas UK. This value is adjusted annually for inflation. Gift 350000 Minus the Inheritance Tax threshold on 27 March 2021 325000 Amount on which tax can be charged 25000 Tax on the gift at 40 25000 X 40 Tax.

However if you are UK tax resident and you make a capital gain abroad from the sale of a property. For purported gifts from foreign corporations or foreign partnerships you are required. Then this will need.

If the gifts or bequests exceed 100000 you must separately identify each gift in excess of 5000. Further you must report foreign gifts from foreign corporations or foreign partnerships of more than 16649 as of tax year 2020 on form 3520. Further you must report foreign gifts from foreign corporations or foreign partnerships of more than 16649 as of tax year 2020 on form 3520.

HMRC calls this the annual exemption. Again it is simply a declaration. Find out whether you need to pay UK tax on foreign income - residence and non-dom status tax returns claiming relief if youre taxed twice including certificates of residence.

Person receives a gift from foreign person and the value of gift exceeds either the individual foreign person or. 16 rows Estate Gift Tax Treaties International US. Donations tax is payable by the donor and not the recipient - therefore there are no tax implications for you however you need to disclose it in your tax.

Before the finance act. In addition gifts from foreign corporations or partnerships are. If you happen to receive money from a foreign corporation or partnership as a gift and it is above.

The general rule is that you can gift up to 3000 tax-free each tax year.

Do I Have To Pay Uk Tax On My Foreign Income Oxford Accountants

Transmitter Information Transmitters Of Information Returns 1098 1099 3921 3922 5498 W 2g Must Complete The Transmi Tax Software Irs Credit Card Hacks

Cleartax S Infographic Of What Incomes And Losses The Different Itr Forms Include And Exclude Residual Income Business Income Tax Return Website Income

Non Resident Indian Nri Definition Under Fema Smart Paisa Finance Guide Resident Definitions

Federalism Poster Zazzle Social Studies Education Education Poster Social Studies Classroom

Us Tax Question Do You Have To Have A Tax Home In Another Country To Qualify For The Foreign Earned Income Exclusion Tax Questions Income Global Peace Index

The Brittish Pound Scotlands Type Of Money Google Image Result For Http Www Myguidebritain Com Blog Wp Content Uploads 2 Moedas Moeda Estrangeira Moeda

Do I Have To Pay Uk Tax On My Foreign Income Oxford Accountants

What Is Probate See More At Http Www Andersons Com Au Lawtalk Posts 2014 November What Is Probate A Estate Planning Estate Planning Attorney How To Plan

Legalization Service Centre Is Experienced And Reliable Service Company Committed To Pro Birth Certificate Template Certificate Templates New Birth Certificate

Us Tax Question Do You Have To Have A Tax Home In Another Country To Qualify For The Foreign Earned Income Exclusion Tax Questions Income Global Peace Index

How The Us Gift Tax Applies To Foreign Nationals Bny Mellon Wealth Management

Masters Degree Certificate Template Awesome Ghana Birth Certificate Sample Paramythia Teacher Assistant Jobs Certificate Templates Assistant Jobs

Taxes On Money Transferred From Overseas In The Uk Dns Accountants

Gifts From Foreign Persons New Irs Requirements 2022

Pin By Marko Orso On Pink Compass Vintage Compass Antique Brass Antiques

Gifting To Us Persons A Guide For Foreign Nationals And Us Donees Bny Mellon Wealth Management

Transfer Money From Overseas To Uk Tax Implications Moneytransfers Com